Self Assessment Services for Sole Traders and Small Businesses

Boost your earnings with confidence.

Our self‑assessment specialists handle the calculations and prepare your return swiftly and accurately. Every submission is completed and filed with HMRC on schedule, without fail.

What We Deliver

We provide comprehensive accounting solutions built to support growth.

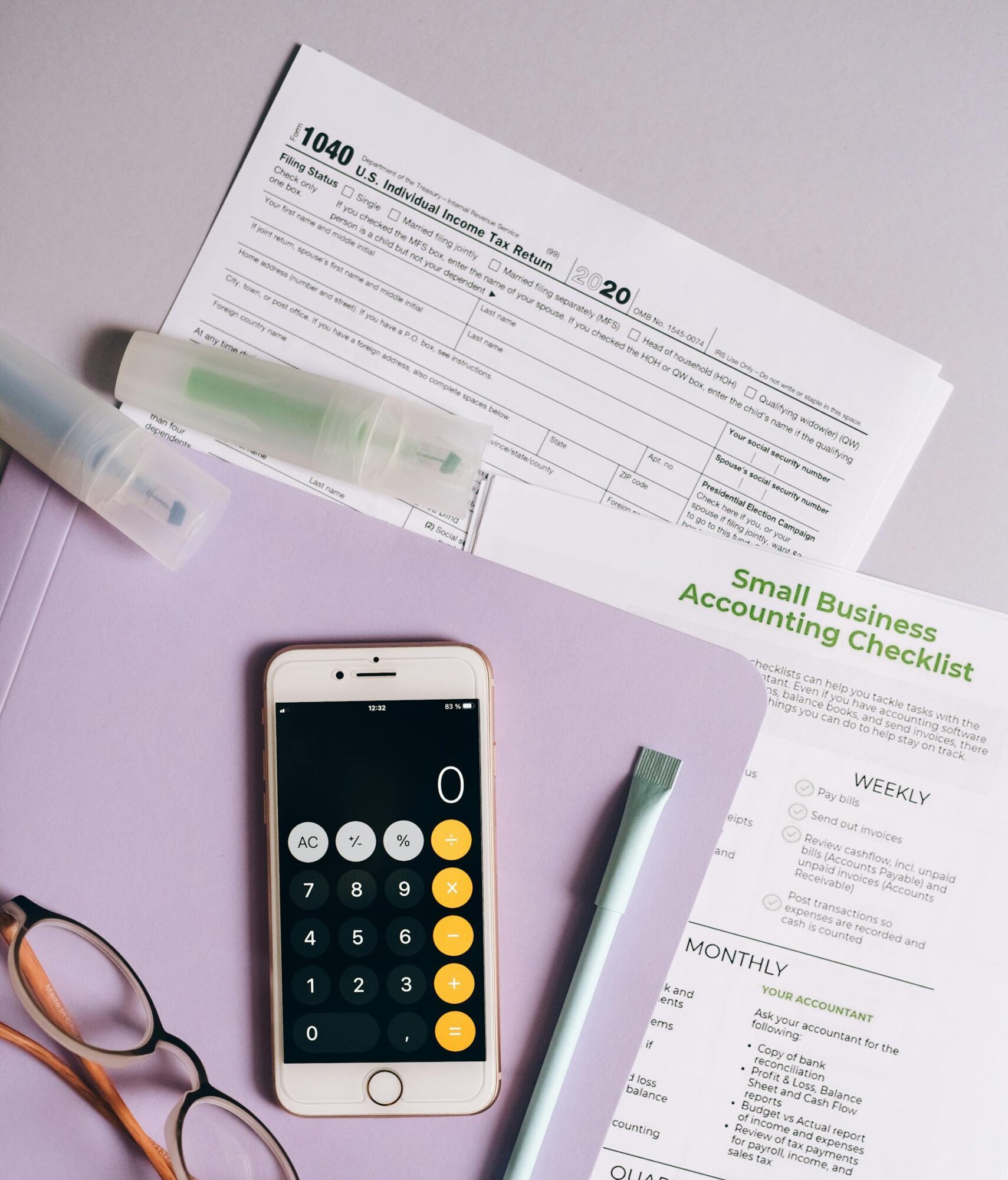

Our Comprehensive Tax Return Service

We manage the entire process of completing and submitting your personal tax return through a clear 9‑step approach:

- Provide you with a tailored checklist to simplify gathering all required information.

- Use the details you supply to accurately prepare your Personal Tax Return.

- Calculate tax bills and payments on account to prevent penalties and interest.

- Advise on potential claims and elections to reduce liabilities (excluding tax credits), and submit HMRC‑required elections if instructed.

- Secure your written approval before filing your return.

- Submit electronically to HMRC, ensuring confirmation of receipt and faster refunds where applicable.

- Request your bank details to transfer refunds directly and securely.

- Handle all HMRC correspondence related to your tax return, whether sent to us or forwarded by you.

Industries We Support

Tailored Self Assessent for Every Sector

Self Assessment needs vary across industries, and our expertise ensures your records are managed with precision no matter your field.

- Contractors & Freelancers: Simplified expense tracking and reporting for self‑employed professionals.

- Startups & SMEs: Scalable bookkeeping solutions that grow with your business and support long‑term planning.

- Hospitality – Daily records managed using leading cloud-based tools

- Retail: Stock management, daily transaction recording, and VAT compliance for shops and multi‑location businesses.

- Professional Services: Accurate invoicing, VAT compliance, and client account management for consultants and agencies.

- E‑Commerce Businesses: Integrated bookkeeping with online sales platforms, ensuring accurate records and tax compliance.

- Landlords: Tailored tax and accounting solutions that simplify rental income management and ensure full HMRC compliance.

Expert Tax Guidance

Our service goes beyond simply completing self‑assessment tax returns. Our qualified accountants provide tailored advice and strategies to help minimise your tax liability, ensuring you receive genuine added value rather than just routine number crunching.

We keep clients fully informed and in control of their tax obligations and financial position, empowering them to make confident, well‑considered business and investment decisions.

What is a Self‑Assessment Tax Return

A self‑assessment tax return, often referred to as a Personal Tax Return, is the method by which individuals report their annual income and any gains or profits from capital investments to HMRC.

While some taxes are deducted automatically at source — for example, PAYE on employment income or tax on savings interest — other types of income are not. Earnings from rental properties, sole trader businesses, or the sale of assets that have increased in value (such as buy‑to‑let property) must be declared separately, with any additional tax paid.

A tax return can also be used to reclaim overpaid tax, such as when an incorrect tax code has led to excessive deductions by an employer.

Who Needs to Complete a Personal Tax Return (PTR)

A tax return is required for the financial year ending 5th April if any of the following apply:

- Self‑employed sole traders running their own business or service.

- Partners in a partnership.

- Individuals with more than £2,500 in untaxed income, such as rental property earnings.

- Investors receiving dividend income.

- Savings or investment income of £10,000 or more before tax.

- Profits from selling assets, including buy‑to‑let property or shares.

- Recipients of child benefit where income exceeds £50,000.

- Income from abroad that is subject to UK tax.

- Individuals living abroad but earning UK income.

- Trustees managing trusts.

Our Approach

We provide comprehensive accounting solutions built to support growth.